KUALA LUMPUR, Sept 27 — Former prime minister Datuk Seri Najib Razak had appointed a mandate holder or authorised person to handle his personal bank accounts at AmIslamic bank, but the appointment of such authorised persons are usually only for special situations, the High Court heard today.

AmIslamic bank’s Jalan Raja Chulan branch manager R.Uma Devi said this while testifying as the 37th prosecution witness in Najib’s trial over the alleged misappropriation of RM2.28 billion of 1Malaysia Development Berhad (1MDB) funds.

Asked by Najib’s lawyer Wan Aizuddin Wan Mohammed if it was normal for a person or a company which has a bank account to appoint a mandate holder, Uma Devi said this would be only in limited situations.

“For individual account, no. Under certain circumstances like prolonged illness, generally prolonged illness, or they can’t really handle account due to old age, we do have mandate. But it’s not a normal practice,” she said.

Uma Devi confirmed, however, that having a mandate holder is “allowed under special cases”. Prior to these questions, Wan Aizuddin had shown Uma Devi a letter from Najib in March 10, 2011 to notify the bank of his appointment of Nik Faisal Ariff Kamil to be the authorised personnel for his two AmIslamic bank accounts ending 0481 and 9694.

The 9694 account belonging to Najib is the AmIslamic account where more than RM2.08 billion had entered in just nine transactions within 20 days in 2013, and was also where more than RM2.5 billion had flowed out in just over four months the same year before Najib closed down the account in August 2013.

In the March 10, 2011 letter, Najib had told AmIslamic bank that he was authorising Nik Faisal to make enquiries on the bank accounts’ status including the balance of money left and to confirm cheques for amounts larger than RM250,000.

Najib also told the bank to clear and confirm all cheques below the value of RM250,000 without checking with him or Nik Faisal.

While confirming that cheques beyond the amount of RM20,000 would usually require confirmation from customers before the bank clears the cheque to be paid to recipients, Uma Devi said the bank may also need to confirm cheques below the amount of RM20,000 if there were ambiguities with such cheques.

Based on Najib’s March 2011 mandate letter to confirm cheques issued from his personal accounts when the cheques are beyond the amount of RM250,000, Uma Devi agreed that this meant the usual requirement to confirm cheques once it hits RM20,000 has been bypassed.

Uma Devi agreed that a bank branch officer would usually be in charge of contacting the account holder to ask for the confirmation of cheques.

But in situations where there is a relationship manager at the bank directly in charge of handling the accounts — such as for Najib’s bank accounts, Uma Devi said the bank branch would then contact the relationship manager to ask the latter to confirm the cheques with the account holder.

Asked by Wan Aizuddin if there would be any breach of banking rules if the relationship manager fails to contact the account holder for cheque confirmation and simply says the bank customer had confirmed the cheques, Uma Devi said there would be a breach but with the bank only knowing if the customer complains.

“Yes, if there’s a dispute by the customer, there would be. Because we would only know — we would only do the clearance as per standard operating procedures — if the customer complains, only then we would know whether there’s a breach or not. Because there’s a relationship manager and we trust the relationship manager would have done their job,” she said.

Wan Aizuddin then asked the hypothetical question of how a bank customer could complain if he does not even know of the cheques as the relationship manager never contacted him.

Uma Devi then said bank customers should have checked the transactions in the statement of their bank accounts, describing it as a “duty”.

“Customers are given a statement of account, it’s his duty to check monthly. We have customers who even check even when one cent goes off. In the bank, we don’t take that for granted. So customers will check their account,” she said.

Quizzed by Wan Aizuddin on her remark that it is the duty of customers to check their accounts on a monthly basis, Uma Devi explained that this was her personal thought and confirmed it was not written down as a legal duty: “I’m the customer, I will check my account. As far as I know, all customers would check their accounts. It’s our duty, this is my personal thought, it’s not written.”

Earlier, Uma Devi had explained that an account holder — such as Najib — would usually receive a monthly copy of their statements of account to the address they have given, noting that the balance could also be checked at the bank or via an ATM card, or through online banking since online services became available.

Wan Aizuddin today asked Uma Devi about a July 30, 2013 letter from Najib to the head of AmBank’s Group Treasury and which was copied to the bank’s then managing director Cheah Tek Kuang, where Najib confirmed his instruction to the bank to convert the ringgit in his 9694 account into US$620 million which he claimed represents “the unutilised sum of donations and personal gifts I had received” to be transferred out to a beneficiary that he would be naming in a separate letter of instruction.

Uma Devi confirmed she had never seen a remittance amount from a personal bank account larger than this US$620 million sum. She said she was unable to confirm if the US$620 million transaction was carried out as instructed by Najib, based on just the details available in the bank’s internal copy of the statement of account and unless further documents were shown to her.

Previously, AmBank’s SWIFT unit manager Wedani Senen had confirmed that over US$730 million had entered into Najib’s 9694 account from the years 2011 to 2013, including a US$620 million sum and a US$61 million sum from Tanore Finance Corp’s account on March 22, 2013 and March 25, 2013.

The prosecution had said Tanore was controlled by fugitive Low Taek Jho’s associate Eric Tan.

Wedani had previously also confirmed an August 21, 2013 letter from Najib to AmIslamic Bank’s Jalan Raja Chulan branch manager, instructing for money to be transferred out from his 9694 account to Tanore’s bank account, and that a sum of over US$620 million was sent from the 9694 account on August 26, 2013 to the Tanore account.

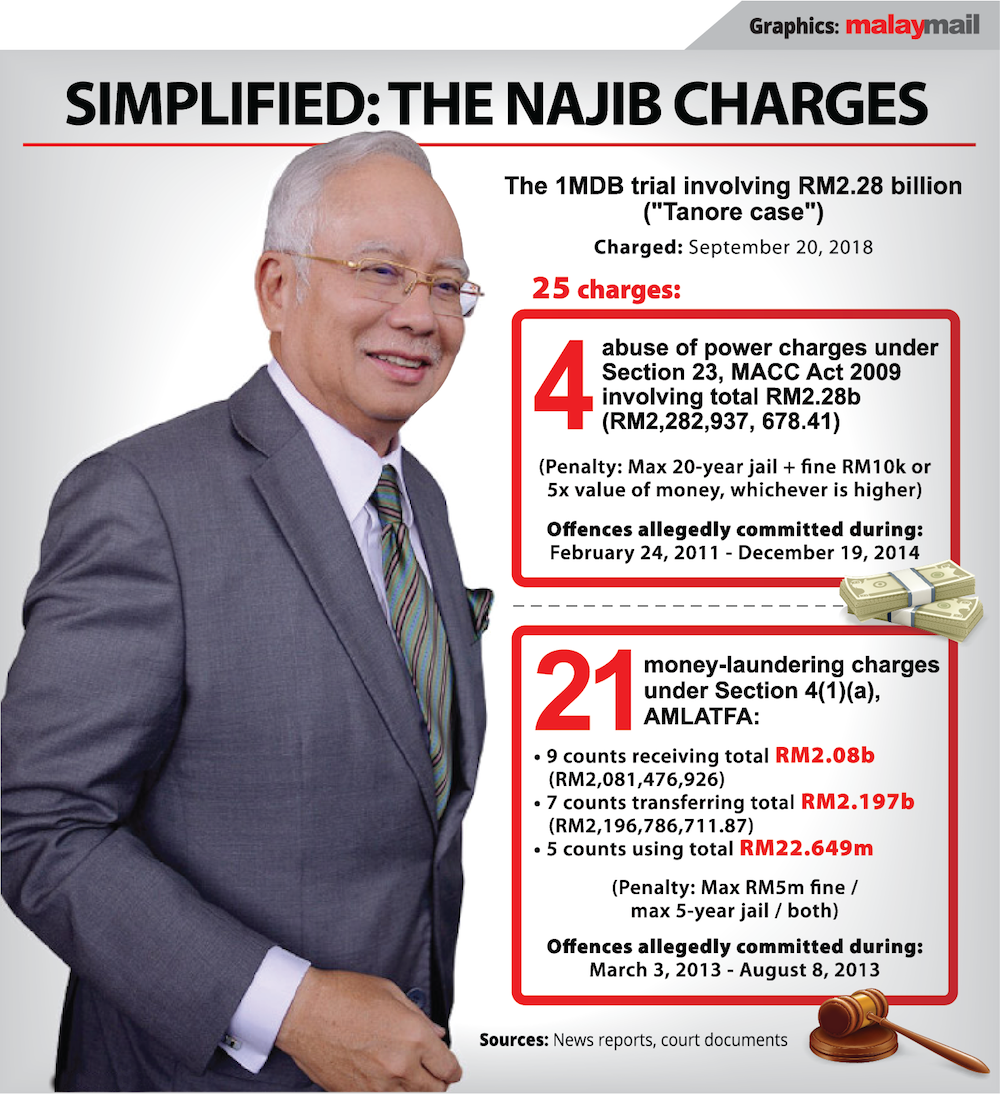

The total of 1MDB funds that the prosecution had said it would prove had entered Najib’s accounts from all four phases of the 1MDB scheme would come up to a total of RM2,282,937,678.41 or over RM2.28 billion.

On the first day of trial, the prosecution had said it would show that 1MDB funds had been transferred in multiple transactions to Najib’s accounts, namely US$20 million equivalent to RM60,629,839.43 or over RM60 million from the first phase of the 1MDB scheme, US$30 million equivalent to RM90,899,927.28 or over RM90 million (second phase), US$681 million equivalent to RM2,081,476,926 or over RM2 billion (third phase), and transactions in pounds sterling that were equivalent to RM4,093,500 and RM45,837,485.70 or a combined total of RM49,930,985.70 million or over RM49 million (fourth phase).

Previously, the prosecution said it would prove the 21 money-laundering charges against Najib in this 1MDB trial by showing various transactions, including a sum of RM2,034,350,000 that he had allegedly transferred to Tanore between August 2 and August 23, 2013.

Naijb’s 1MDB trial before High Court judge Datuk Collin Lawrence Sequerah resumes tomorrow.