KUALA LUMPUR, Dec 7 ― Planet, people and prosperity ― or the Three Ps ― are the new frontier of Islamic finance in bringing greater value to the economy, society and the environment, says the Sultan of Perak, Sultan Nazrin Shah.

While in many tangible ways Islamic finance industry has already helped to generate more socially conscious and sustainable economic system, much work needs to be done in these three key areas, he pointed out.

On the first P, the Perak ruler said with many countries declaring climate emergency, the welfare of the planet is certainly an area in which immediate action is needed.

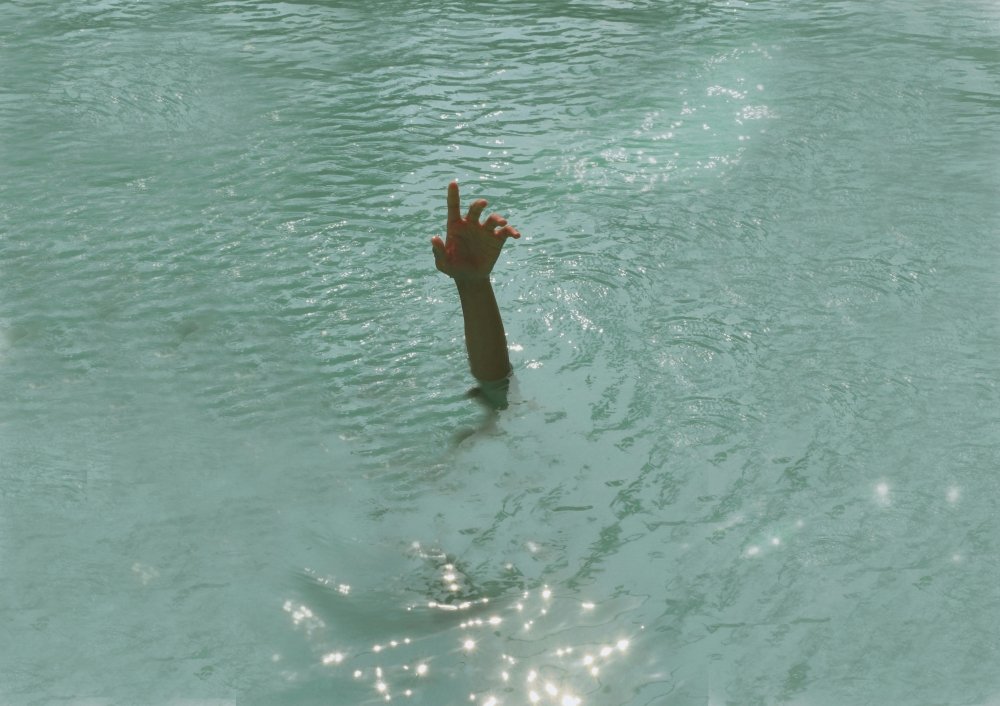

As for the second P, he said the world is witnessing huge movements of people due to conflict, persecution, and hardship.

“By 2030, an estimated 80 per cent of the world’s extreme poor will live in areas defined as fragile, the majority of which will be Muslim-majority countries or states with significant Muslim populations,” he said in his speech before receiving a honorary doctorate in Islamic finance at INCEIF 11th convocation at a hotel here today.

Regarding the third P, prosperity, which is unseparable from the other two, Sultan Nazrin said high indebtedness, widening inequality and substantial funding shortfalls hamper the efforts both in addressing the hardships of people in need and also in protecting the planet.

He added that Islamic finance has the potential to make a significant, and even vital, contribution to redressing these serious shortfalls as its core is based on principles that emphasise, among other objectives, equitable risk-sharing and inclusiveness.

Sultan Nazrin said that it also requires Shariah-compliant transactions to be based on real, productive assets. All of these principles promote fiscal responsibility and sustainability, meaning that the industry is well-placed to withstand economic turbulence and provide reliable, long-term solutions to alleviate poverty as well as the climate and humanitarian crises.

Furthermore, he said, Islamic finance is rooted in the Maqasid Shariah.

“The Shariah laws which govern it are designed to protect both the individual and the community, and to improve the living conditions of mankind.

“The traditional instruments of Islamic finance, such as waqf and zakat, are being effectively utilised and targeted towards the needs of the modern world,” he said.

In 2018, the International Federation of the Red Cross and Red Crescent Societies (IFRC) used zakat monies to fund a drought assistance programme in the Kenyan county of Kitui, pioneering a sustainable humanitarian zakat initiative. ― Bernama