APRIL 12 — The world is still in the grip of Covid-19. If you scan the newspapers and news sites, the headlines and virtually every other story is about nothing but Covid-19.

Understandably, of course.

Thousands have lost their lives to the virus and the lockdowns that have been rolled out to contain it are like nothing the world has ever seen.

But as we all live through the time of Covid-19, it’s important to remember the virus isn’t everything.

It is easy to imagine that as much of the world has been locked down, nothing has really been happening.

It seems like we all currently exist in a state of limbo where the usual run of innovation, commerce, politics and academics has ceased but that’s not true.

Things are always happening. Everything is constantly changing.

One clear change we’ve seen over these last few weeks of limbo is the price of oil.

Before the world was gripped by the virus, oil was trading at around US$60 (RM258) a barrel.

As lockdowns took their full effect, oil plummeted to US$20 a barrel. One of the steepest falls in history.

Now oil has gone through ups and downs in price before but this time something is different.

While it’s easy to assume the price of all oil has fallen because economies have stopped and there’s no demand for the product, there is more to the current price falls than that.

As demand has fallen due to Covid-19, major oil-producing countries particularly Saudi Arabia and Russia have not reduced supply — something they typically do when the price of oil falls.

Instead they have kept producing large volumes of oil.

They did this first because neither wanted to give up market share to the other and second because they feel lowering the price will force higher cost producers of oil — particularly US shale-based oil — out of the market.

Again, we’ve seen this kind of strategy before; price wars are nothing new but this time the stakes seem higher.

There seems to be even less willingness to compromise and that may be because we are beginning to see the end of oil on the horizon.

For much of the last century, oil was the indispensable global commodity. Powering cars, planes, ships, generating electricity and serving as the base for plastic and all sorts of materials we use every day.

Over 80 million barrels are produced per day. That’s between 20-30 billion barrels per year of four or five barrels for every human on earth.

It’s hard to overstate how fundamental oil is. Wars have been fought for it and people have died for it. But this time, oil’s low prices might be here for a long time.

Basically, there is a sense that we are now nearing peak oil — the year in which global demand for oil reaches its height.

After that, demand will fall year after year and this will have a large impact on oil suppliers and prices.

Increasing awareness of the importance of sustainability, laws and regulations limiting the use of fossil fuels in many major economies and the rise of electric cars means that a world that requires less fossil fuel is looking quite likely.

Keep in mind that it will be less demand, not no demand. Demand for oil isn’t going to stop any time soon — electric planes are in their infancy and plastics are still irreplaceable but a reduction will still transform the industry.

Some argue that the Saudi Arabian and Russian government understand peak demand may be around the corner and are looking to pump and sell as much oil as possible before falling demand permanently lowers the amount they can sell.

The fear is that they we will eventually be left with large reserves of a commodity that just isn’t much in demand. This is broadly what happened to coal 50 years ago.

In that context, huge amounts of infrastructure became obsolete; some regions never recovered from the end of coal.

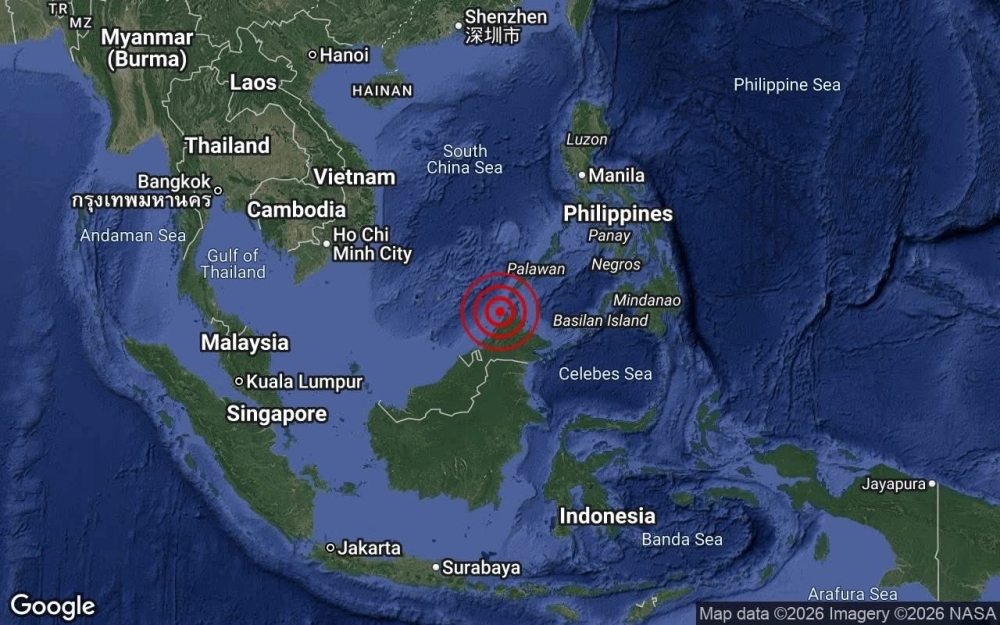

Around the world and in our region too, the decline of oil will present real challenges.

Just thing of the extent Singapore is devoted to refineries and oil storage. The sector contributes at least 5 per cent of our GDP though when you add repairs to ships and rigs and plastics, the figure is higher.

In Malaysia, up to 20 per cent of GDP and 20 per cent of government revenue comes from oil and gas. So as demand for the commodity falls, our nations will have to change.

While this is something many governments would have anticipated, Covid-19 may well accelerate the process. The disease will likely see a permanent increase in telecommuting and see many governments intensify their moves against private cars.

Of course, in many ways this is a change we should welcome. Oil has many uses, but it has contributed to wars and considerable pollution and environmental degradation.

But there will also be real consequences to the economy and people’s jobs.

Governments thinking about getting their economies up and running in the immediate term will also have to consider changes like this.

How rapid the changes will be will depend on how quickly demand for oil falls but Covid-19 has taught us that things can change faster than we anticipate and it pays to be ready.

*This is the personal opinion of the columnist.