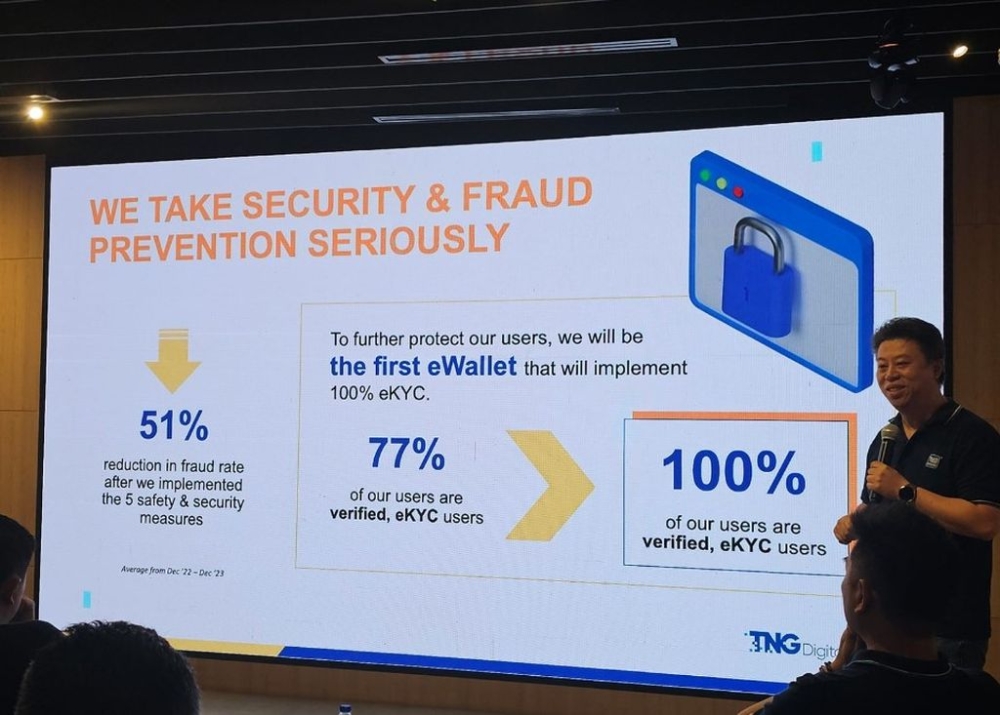

FEBRAURY 29 — At the Touch ‘n Go media briefing today, the company confirmed that it will be implementing electronic Know-Your-Customer (eKYC) verification for its customers, as it aims to have 100 per cent of its customers verified. This is part of the company’s drive to tighten security for its user base.

Currently, the eWallet has over 26 million registered users, or about two-thirds of the Malaysian population. Out of the registered users, 20.9 million are verified users via eKYC which translates to around 77 per cent.

When asked, Allan Ni, the CEO of TNG said that this approach will further ensure stringent user authentication, fostering a more secure digital payment ecosystem. This will help to reduce fraud among eWallet users and reduce incidences of mule accounts in the future.

The company is targeting the exercise of verifying all customers by the third and fourth quarters of 2024. For accounts that are not verified after the end of the exercise, it will be closed by the company. However, this will only happen after reminders have been given to the account owner to verify using eKYC.

They acknowledge that there are some obstructions to verifying all accounts – for example when the account owner is a parent, but the main user is a child. However, the company will be working to work with these owners to have a seamless transition to verification in the future. — soyacincau