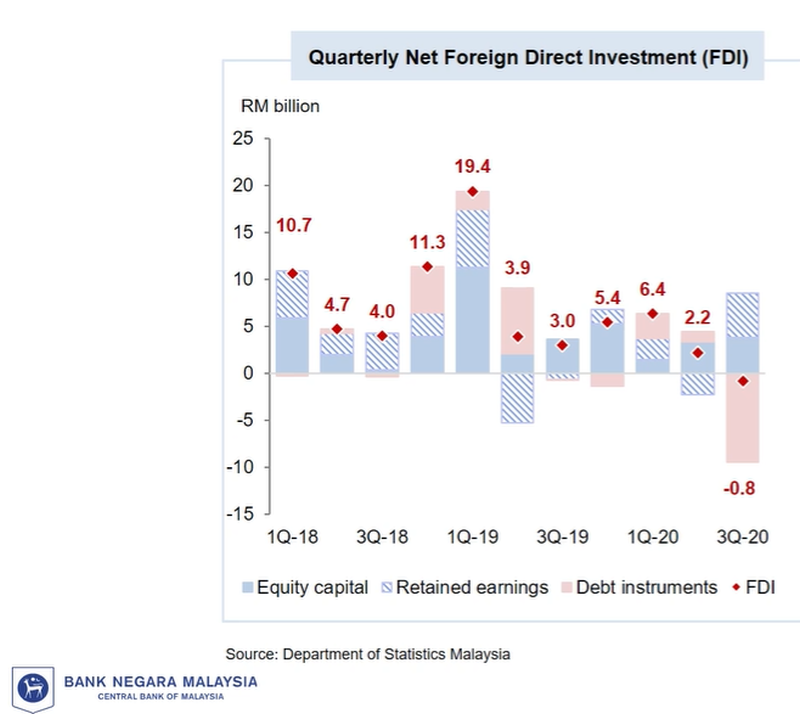

KUALA LUMPUR, Nov 13 ― Foreign companies are not pulling out their investments from Malaysia, as the RM0.8 billion outflow in foreign direct investment (FDI) recorded in the third quarter of 2020 was due to such companies giving out or repaying loans, Bank Negara Malaysia (BNM) said today.

BNM governor Datuk Nor Shamsiah Mohd Yunus said instead that foreign investors continue to remain keen on keeping their investments in Malaysia.

She then proceeded to explain the three components of the net FDI figures for each quarter, namely debt instruments, retained earnings and equity capital.

“The data indicates that FDI firms have not divested from Malaysia.

“So the negative FDI during the third quarter reflects two developments. First, intercompany loan extensions and scheduled loan repayments ― about RM5.5 billion if not mistaken ― by manufacturing firms, particularly in the Electrical and Electronics (E&E) sector, and this is a common practice among MNC (multinational companies) operations,” she told the media during an online briefing today when asked if foreign investors were divesting from Malaysia.

“Secondly, about RM3.6 billion of trade credit extensions were given. This reflects strong demand of E&E exports by these FDI firms,” she said, referring to manufacturing firms granting trade credits ― or the practice of allowing customers to buy first on account and pay later ― in line with strong exports especially in the E&E sector.

“So despite these outflows, FDI firms recorded higher retained earnings and equity capital injections in Malaysia, and this amounted to about RM8.5 billion in the third quarter, compared to RM1.1 billion in the second quarter.

“So this indicates that they remain vested in Malaysia and will continue to see valuable opportunities in the country,” she concluded.

According to BNM’s quarterly bulletin for the third quarter of 2020 which was released today, this is the first time that FDI outflows has been recorded in Malaysia since the fourth quarter of 2009.

In explaining the RM0.8 billion outflow in FDI for the third quarter in 2020, BNM’s quarterly bulletin said this was driven by debt instruments (-RM9.4 billion in the third quarter of 2020 against RM1.1 billion in the second quarter of 2020) via intercompany loan extensions and scheduled loan repayments, as well as tax credits.

But the outflows in FDI from debt instruments were partially offset by higher earnings (RM4.8 billion in third quarter of 2020 against -RM2.2 billion in the second quarter of 2020) generated and retained especially by FDI firms in the manufacturing sector, as well as higher injection of equity capital (RM3.8 billion in third quarter of 2020 against RM3.4 billion in second quarter of 2020) which indicated Malaysia’s attractiveness to foreign investors.

Today, the Department of Statistics Malaysia (DOSM) released its quarterly bulletin on FDI figures in Malaysia for the third quarter of 2020, similarly remarking that this quarter had registered a net FDI outflow of RM0.8 billion after having recorded continuous FDI inflow since 2010.

Today, the Department of Statistics Malaysia (DOSM) released its quarterly bulletin on FDI figures in Malaysia for the third quarter of 2020, similarly remarking that this quarter had registered a net FDI outflow of RM0.8 billion after having recorded continuous FDI inflow since 2010.

The top three contributors to the FDI outflow in the third quarter of 2020 are Netherlands (-RM1.6 billion), the UK (-RM1.4 billion) and Cayman Islands (-RM0.9 billion), noting that some of the companies from these countries in the manufacturing and mining sector had extended trade credits and loans to their affiliates abroad.

As for the FDI position in Malaysia, it was at RM689.6 billion as at the end of the first quarter of 2020, before increasing to RM696.5 billion in the second quarter of 2020, and decreasing to RM689.1 billion in the third quarter of 2020 or by the end of September 2020.

The three biggest contributors to Malaysia’s FDI position for the third quarter are Singapore (RM149.8 billion), Hong Kong (RM86.2 billion) and Japan (RM74.1 billion), with these three collectively contributing to 45 per cent of the total FDI position of RM689.1 billion, the DOSM said.

As for the biggest contributors by sector to the RM689.1 billion FDI position, it was the services sector (RM359.3 billion or 52.1 per cent) driven by financial and real estate activities, followed by the manufacturing sector (RM266 billion or 38.6 per cent), DOSM’s data showed.

Private investments to pick up in 2021

Today, Nor Shamsiah predicted that the growth in investments from the private sector will be boosted in 2021.

“Private investment growth is expected to rebound next year, this is supported mainly by increasing global and domestic demand, and the continued progress of large investments projects and stimulus measures,” she said.

She said the recovery in external demand will underpin investments especially in the export-oriented industries which accounts for about 51 per cent of total investments or gross fixed capital formation, including investments in industries such as the E&E, primary-related manufacturing products and logistics subsectors.

She also noted that construction activities have picked up following the relaxation to operating restrictions amid the Covid-19 pandemic, with the progress of large infrastructure projects expected to support the growth in private investments.

“Third, growth will also be lifted by continuous stimulus measures from Penjana and Budget 2021. This includes investment incentives, and the implementation of various projects including Jendela which is a digital infrastructure plan to improve digital connectivity in Malaysia and build the foundation for the adoption of 5G technology,” she said.

“Fourth, approved investments particularly in the manufacturing sector remain high. In the first three quarters of this year, about RM65 billion worth of projects was approved, this was driven by petroleum products including petrochemicals and E&E industries. So the realisation of these approved investments next year will also provide support to our growth next year,” she added.

Nor Shamsiah went on to say that attracting quality investments will be key in driving a more sustainable economic recovery for Malaysia and to achieve its aspirations of becoming a high-income nation.

“So in particular, we should aim to attract quality investments that can increase the sophistication and value-add of our product and services, facilitate the creating of high-skilled and high-paying jobs for locals and deepen domestic linkages among industries, so this will be key for us going forward,” she said.