SHAH ALAM, March 4 — The Employees’ Provident Fund (EPF) said today it is not in favour of another round of early withdrawal as many Bumiputera account holders have alarmingly low retirement savings.

Chief executive officer Datuk Seri Amir Hamzah Azizan said multiple pandemic-related withdrawals have significantly eroded saving levels for Bumiputera and ethnic Indian savers.

“For us, we cannot allow more withdrawal because the base range after pandemic has gotten too low for some groups,” said Amir Hamzah during the EPF 2022 financial performance media briefing here today.

He pointed out that median EPF savings for Bumiputera savers have gone down from RM15,500 to RM4,900 as of December 2022, a significant 70 per cent drop.

Meanwhile, ethnic Indians’ savings went down 40 per cent from RM25,700 to RM14,900, while the ethnic Chinese group recorded the lowest reduction of one per cent from RM45,800 to RM45,200 after pandemic ended.

He added that the total withdrawn amount during the pandemic period stands at RM145.5 billion.

This comes as the opposition coalition Perikatan Nasional (PN) has been insisting for the government to continue the withdrawals.

The special withdrawals were first introduced during the stint of PN chairman Tan Sri Muhyiddin Yassin as prime minister in 2020, and was continued by his successor Datuk Seri Ismail Sabri Yaakob.

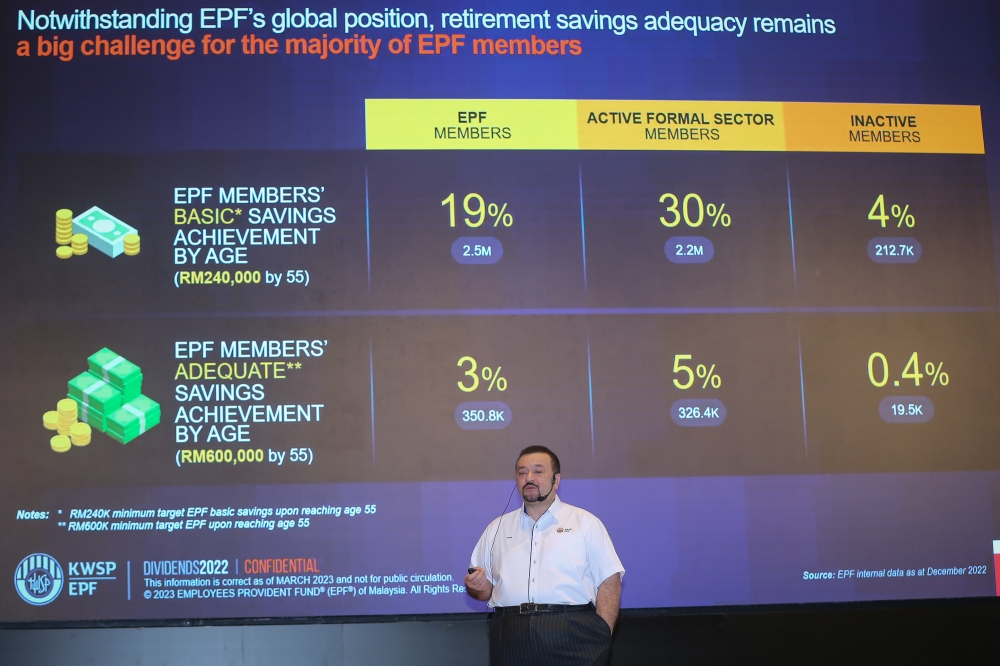

Meanwhile, Amir Hamzah said that Malaysians’ retirement security remains EPF’s key priority because only 36 per cent of its near-retirement members have achieved the basic savings requirements.

EPF’s basic saving target is set at a minimum of RM240,000 upon reaching the retirement age of 55.

He also voiced his concern over the fact that only 19 per cent of active members have achieved the basic saving targets while only 3 per cent reached the adequate saving target, which stands at having RM600,000 in the EPF account by the age of 55.

“We think that this minimum threshold needs to be pushed harder, we need to get more members at the very least to reach the basic saving targets. The scary thing is that only 19 per cent of our active members have reached this very threshold we have set for basic savings.

“We need to do better, the country needs to be better and focus on addressing potential retirement security issues,” said Amir Hamzah.

During the press conference, Amir Hamzah added EPF welcomed the separation of Shariah savings and conventional savings as announced by Finance Minister Datuk Seri Anwar Ibrahim when Budget 2023 was tabled last week.

Amir Hamzah said the new implementation would help to optimise Shariah compliance assets investment return rate by having clear guidelines for both accounts.

“Separating both schemes is not because certain things that we invest in are not halal, but because they have an overall control on the limit we can invest,” said Amir Hamzah.

The EPF announced today a dividend rate of 5.35 per cent will be given to conventional savings for 2022, with a total payout of RM45.44 billion.

Meanwhile, a 4.75 per cent dividend with a total payout of RM5.70 billion for 2022 will be given to Shariah savings members.

* A previous edition of the story contained an error which has since been corrected.