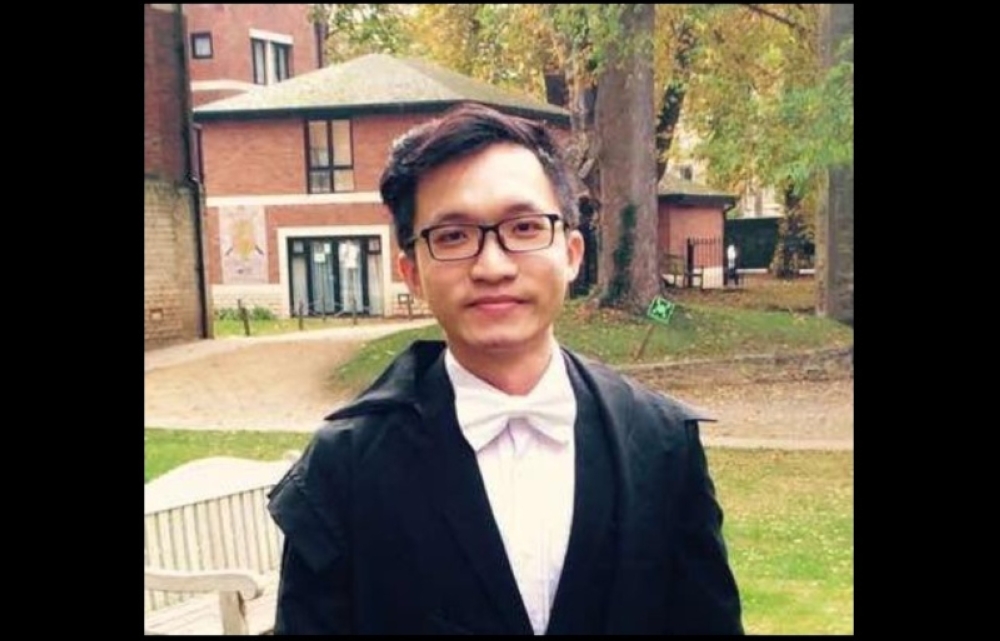

SINGAPORE, April 30 — A 45-year-old man linked to Singapore’s largest money laundering case was sentenced to 15 months’ jail on Tuesday (April 30).

He is the fifth of 10 accused persons to be dealt with in relation to the case.

Zhang Ruijin pleaded guilty on Tuesday to two counts of forgery-related offences and one of failing to satisfactorily account for property reasonably suspected to be benefits from criminal conduct.

Another five similar charges were taken into consideration for his sentencing.

Zhang, a Chinese national, was initially charged with three counts of forgery-related offences and last Friday was handed five additional charges involving forgery and his inability to account for about S$36 million that flowed into his bank accounts.

Zhang’s 15-month jail term — to be backdated by about eight months to the date of his arrest last August — is the harshest meted out so far in relation to the S$3 billion case.

The four others dealt with before him were handed between 13 and 14 months’ jail each.

What happened

The court heard that Zhang was one of 10 individuals arrested during an islandwide raid on Aug 15, 2023 as part of the authorities’ crackdown on suspected money laundering activities.

Over S$131 million worth of assets comprising cash, cryptocurrency and vehicles, among others, were seized from Zhang.

The court heard that between July and October 2020, deposits amounting to HK$138,179,100 (S$24 million) were made into Zhang’s CIMB account in Singapore.

When the bank asked the accused to explain the source of the monies and provide documentary support, Zhang claimed that the funds came from him selling a property in Macau.

He later submitted a document dated June 20, 2020 purportedly showing the sale.

Prosecutors said Zhang knew this was a forged document because he did not own such a property to begin with, and that he had obtained the document from a person specifically to back up his claim to the bank.

He had similarly provided CIMB another forged document some time in August 2020.

This time, the document purportedly showed that he received a loan of HK$7.5 million, to account for a deposit of such an amount into his account.

Zhang failed to satisfactorily account for his possession of this sum, which is reasonably suspected to represent benefits of criminal conduct, at least indirectly or in part. This became the subject of the third charge against him.

For each count of fraudulent use of forged documents, Zhang could have been sentenced to jail for up to four years, fined, or both.

For not being able to account satisfactorily his possession of property reasonably suspected of representing benefits from criminal conduct, he could have been handed a fine of not more than S$150,000, jailed for up to three years, or both. — TODAY