PETALING JAYA, June 11 — Another multilevel investment scam which left investors poorer by RM400 million has come to light, in the wake of similar scams reported in Penang.

Yesterday, 30 investors lodged 80 police reports claiming they had been duped by Royal Gold Sdn Bhd, a Kuala Lumpur-based gold investment company.

Checks revealed the company was incorporated in June 2012, and was placed on Bank Negara’s (BNM) financial consumer watchlist in September the same year.

The watchlist shows companies and websites which are neither authorised nor approved under the relevant laws and regulations administered by BNM.

The victims in this investment scheme claimed that after investing thousands of ringgit, they did not receive their intended returns which were promised.

Retiree Patmanathan Menon, 65, said he invested over RM200,000 but has yet to see the returns.

“They promised me 15 per cent return of investment on my gold investment including capital,” he said.

“The company officials also claimed they have schemes in oil bunkering and even investment in a land in Bagan Datoh. This however proved to be a delaying tactic as none of us received our investment back,” he said.

Patmanathan also said he was led to believe the investment scheme was legitimate as it used a royal emblem and had an alleged high profile member of the royalty leading the company.

“They used royal emblems on their information pieces and even held seminars on how they would create revenue from our investment.”

Another victim Thomas Zakariah, who invested more than RM50,000 said he also had not received any returns since 2014.

“They offered me gold conversion programmes after they said they weren’t able to pay me the returns they promised.

“However, I still have not received any of the dividends promised. I lodged a police report today (yesterday) to warn people,” he said.

At BNM’s website, the central bank advised the public not to engage with unlicensed and illegal investment services as consumer protection under the laws administered by BNM was not applicable to those who did.

Members of the public who participate in illegal financial activities could also be charged under the law for abetting the operators of such illegal activities.

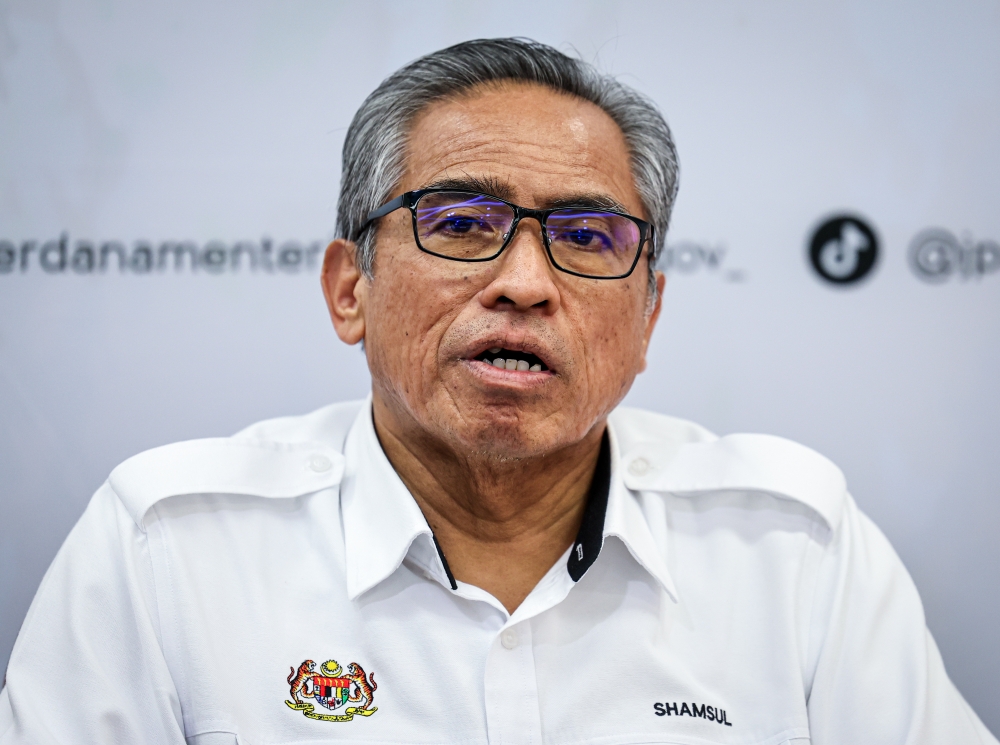

Segambut member of parliament Lim Lip Eng who was with the victims urged the authorities to take action against the company as he claimed there were 1,000 investors nationwide.

“There could be RM400 million lost by investors nationwide. Since 2015, over 100 police reports have been made but no action has been taken.

“We want the matter to be investigated and I urge Bank Negara Malaysia, the Securities Commission, Companies Commission of Malaysia and the Malaysian Anti-Corruption Commission to look into the matter as well,” he said.