KUALA LUMPUR, Aug 24 — Affin Bank Bhd has extended its collaboration with Credit Guarantee Corporation Malaysia Bhd (CGC) to launch the third BizDana/-I Start-up financing scheme with an allocation of RM30 million for Islamic tranche and RM20 million for conventional tranche.

Previously, the BizDana/-I Start-up is offered only for Islamic financing scheme guarantee, and now, for the first time, Affin Bank together with CGC is providing financial support for conventional financing to startups.

Affin Bank president and group chief executive officer (CEO) Datuk Wan Razly Wan Abdullah said since its soft launch last month, the bank has received an overwhelming response from startup companies.

As of today, the latest financial scheme BizDana/-I Start-up has disbursed loans worth around RM9 million to 34 applicants.

“It provides guarantee coverage of 70 per cent which could be utilised as working capital for Malaysian startups to grow and expand their operations without any collateral,” he said at the press conference after the launch of SME Sustainable Conference.

Wan Razly said the financial scheme provides initial working capital for businesses which have been in operations for between six and 36 months, with a minimum financing amount of RM100,000 to a maximum of RM400,000, and repayment tenure of up to seven years.

“Normally, for banking facilities, you have to wait for four years (to apply for financial assistance). So now we are giving the opportunity for startups at their early stage to get banking facilities with the support of CGC.

“It gives more risk (to Affin Bank), so we need to check the customers’ documentation and business plans and we will also guide them along the journey, making sure they are financially educated and understand business accounting, as well as give them assistance,” he said.

The portfolio guarantees are an extension of the partnership between Affin Bank and CGC that began with the first BizDana-i tranche valued at RM15 million in October 2020 and continued with the second tranche valued at RM20 million in June 2021.

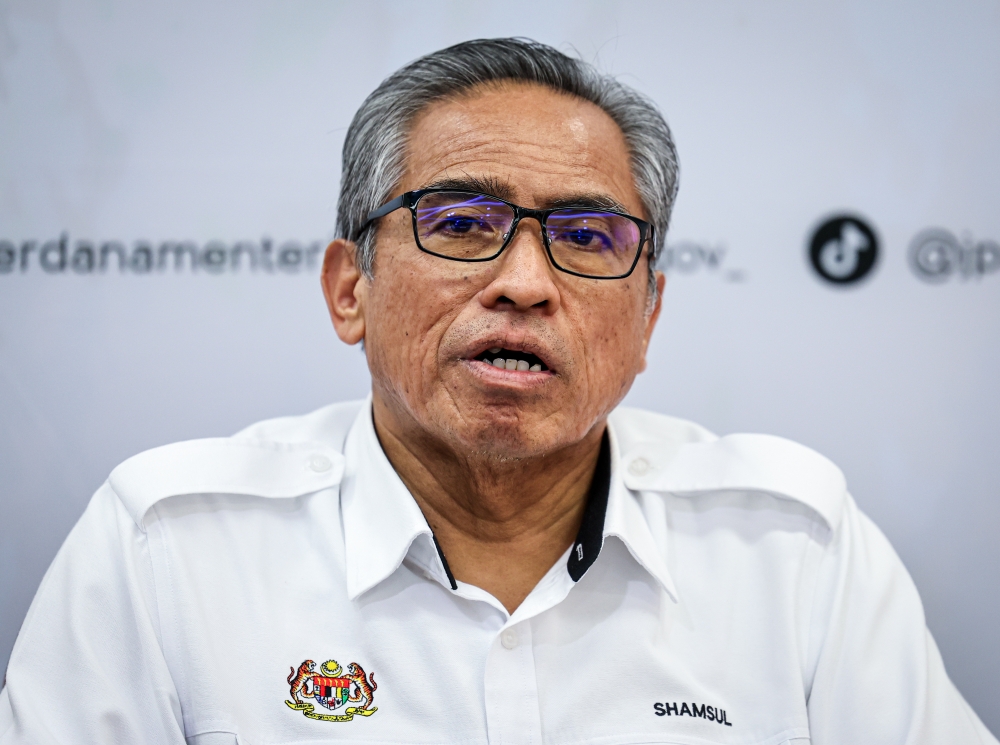

Meanwhile, CGC president and CEO Datuk Mohd Zamree Mohd Ishak said the latest financial scheme is another significant collaboration between Affin Bank and CGC as it stays true to CGC’s commitment to serving the Malaysian Micro, Small and Medium Enterprises.

“With the partnership, CGC has provided guarantees totalling RM375 million to Affin Bank,” said Mohd Zamree.

Meanwhile, Affin Bank has also officially launched Affin Aspira, a platform which provides a comprehensive all-in-one solution from transactions, financing, protection, and advisory to support the aspiration of Malaysian startups in Malaysia.

Under the latest initiative, Affin Aspira is offering various products such as SMEssential, a single business application process to apply for multiple products and services; SMEasy Protect, a business continuity insurance plan; SMEmerge for working capital as financing support; and SMEColony, an award-winning mobile app which serves as a one-stop centre for startups to improve their business knowledge. — Bernama