KUALA LUMPUR, June 21 — As many as 1,000 packs of illegal cigarettes are currently being bought every minute nationwide, available at just one third of the price of legal cigarettes, according to UK-based economics analysts Oxford Economics in a report released yesterday.

The report, commissioned by British American Tobacco (BAT), showed that this equates to 12 billion illegal cigarettes being smoked every year and RM5.1 billion in lost taxes.

Oxford Economics’ director of economic impact consulting, Europe and Middle East, Pete Collings, believes that the illegal cigarette trade will have a negative impact on Malaysia.

“The illegal trade in cigarettes is a major problem in Malaysia. With nearly 60 per cent of consumption falling outside of legitimate channels, the government’s ability to achieve its revenue and health targets is being severely compromised.

“But the damage caused by the illicit tobacco trade goes far beyond unpaid excise duties and sales taxes. The illegal trade, and the syndicates that prosper from it, spreads further illegal activity within Malaysia, encouraging corruption and discouraging legitimate business practices throughout the economy,” he said in a statement after a roundtable held with BAT here yesterday.

The Oxford Economics analysis also claimed that illegal cigarettes make up over half of all cigarettes sold nationwide today, or six out of 10 sticks.

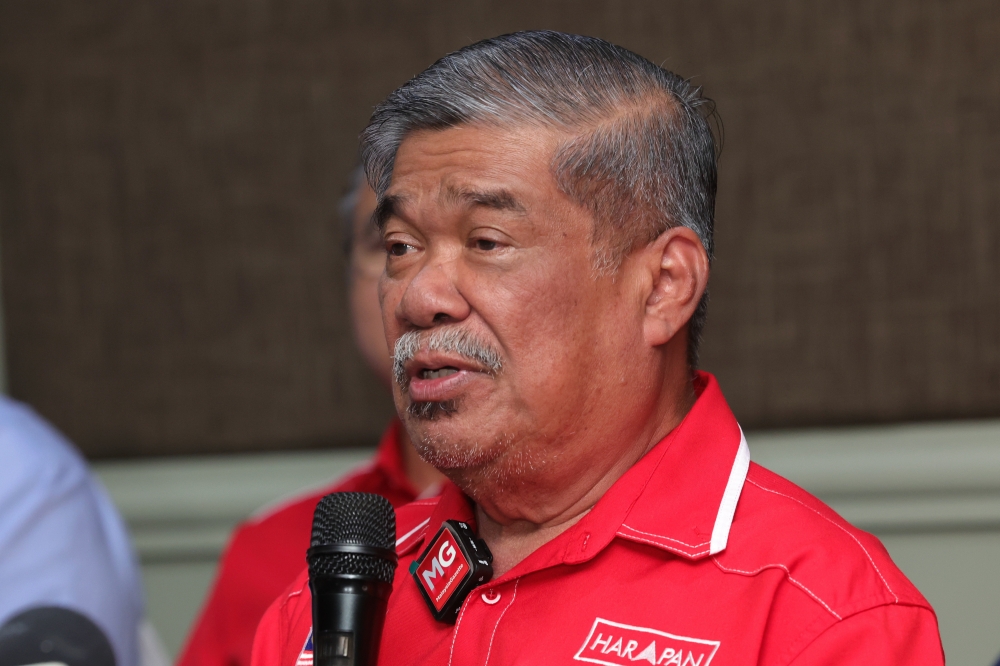

The report noted that consumption of smuggled cigarettes have been on the rise ever since the previous Barisan Nasional government under Datuk Seri Najib Razak introduced a 40 per cent excise tax on tobacco in late 2015.

In comparison, Oxford Economics said just over one-third of cigarettes sold in Malaysia before the 2015 excise tax increase were illegal.

Oxford Economics said that despite strong economic growth, Malaysia’s tax collection has dropped by RM4.8 billion, from RM179.5 billion in 2017 to RM174.7 billion last year.

The global research and investment information firm estimated that the government has only been able to collect RM3 billion in excise duty on cigarettes.

Oxford Economics noted that BAT and another tobacco firm, Japan Tobacco International, closed their Malaysian factories in 2017 due to the increase in illegal trade of cigarettes.

According to the report, the two factories provided 5,750 jobs for people throughout Malaysia during their peak of production in 2013, and made a combined contribution of RM831 million to the economy that year, as well as generating tax revenues of RM161 million.