KUALA LUMPUR, March 11 — Bursa Malaysia closed higher today, bucking the trend of its regional peers, boosted by positive investors sentiment following several announcements made by the government to address the economic slowdown in the country.

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) rose 13.36 points to 1,443.83 from yesterday’s close of 1,430.47.

Bargain hunting in key index stocks and rebound in the oil price have supported the market, dealers said.

After opening 0.88 of-a-point higher at 1,431.35 this morning, the local index moved between 1,428.59 and 1,454.00 throughout the day.

On the broader market, gainers outpaced losers 510 to 397, with 353 counters unchanged, 746 untraded and 17 others suspended.

Turnover increased to 4.47 billion shares worth RM2.86 billion from 4.41 billion shares worth RM3.20 billion recorded yesterday.

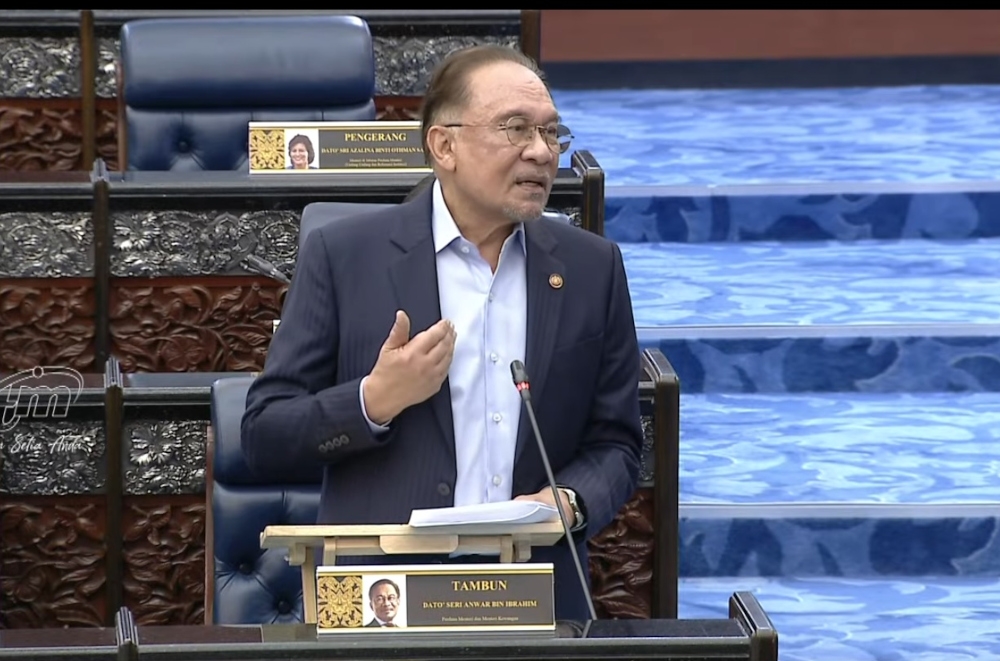

Prime Minister Tan Sri Muhyiddin Yassin today said that the government would form an economic action council, made up of senior ministers, the central bank governor and various experts, to tackle the economic risks and review the government’s finances.

He also mentioned that the RM20 billion stimulus package announced by the previous government would be reviewed to see if it should be increased.

Meanwhile, Datuk Dr Mohd Khairuddin Aman Razali who clocked in as the Minister of Primary Industries and Commodities today said the country aimed to end the dispute with India which had restricted its purchase of crude palm oil.

Commenting on this, AxiCorp chief market strategist Stephen Innes said all commodity markets are moving in tandem with crude oil including palm oil.

“For the longer term, the market would stay depressed so long as Russia and Saudi Arabia continue to be at war on production cuts.

“Taking advantage from this current situation, China is reportedly considering increasing the state oil reserves,” he told Bernama.

Brent crude oil is currently trading at US$36.71 per barrel, down by 1.37 per cent from yesterday.

Among heavyweights, the gainers were led by PetChem, which jumped 37 sen to RM4.72, MISC improved 48 sen to RM7.50, Sime Darby Plantation was up by 16 sen to RM4.61, while Dialog Group was 17 sen higher at RM3.25.

These counters contributed a combined 12.91 points to the gains in the composite index.

Of the actives, energy counters dominated the market, with Sapura Energy and Bumi Armada putting on half-a-sen each to 11.5 sen and 18 sen respectively, while Velesto Energy was 1.5 sen higher at 18.5 sen.

On the index board, the FBM Emas Index increased 94.24 points to 10,080.38, the FBM 70 added 135.03 points to 12,072.98 and the FBM Emas Shariah Index jumped 176.12 points to 10,718.51.

The FBMT 100 Index rose 96.32 points to 9,944.96 but the FBM Ace erased 57.33 points to 4,724.52.

Sector-wise, the Industrial Products and Services Index inched up 3.29 points to 123.45, the Plantation Index climbed 83.97 points to 6,393.58, while the Financial Services Index was 53.82 points lower at 13,913.46.

Main Market volume slipped to 3.18 billion shares worth RM2.63 billion from 3.31 billion shares worth RM2.98 billion recorded yesterday.

Warrants turnover decreased to 328.79 million units worth RM56.97 million versus 380.41 million units valued at RM65.24 million.

Volume on the ACE Market increased to 955.57 million shares worth RM174.36 million from 720.74 million shares worth RM157.12 million previously.

Consumer products and services accounted for 243.36 million shares traded on the Main Market, industrial products and services (282.83 million), construction (192.55 million), technology (318.72 million), SPAC (nil), financial services (67.33 million), property (253.26 million), plantations (59.87 million), REITs (16.97 million), closed/fund (23,500), energy (1.56 billion), healthcare (49.23 million), telecommunications and media (37.06 million), transportation and logistics (44.50 million), and utilities (62.28 million). — Bernama

.jpg)