KUALA LUMPUR, Nov 13 — Bank Negara Malaysia (BNM) today cautioned against reviving a freeze on bank loan repayments for all borrowers, regardless of whether they need such aid or are able to start repaying, warning that the use of debt to drive Malaysia’s economy would not be in the best interests of the country or Malaysians in the long term.

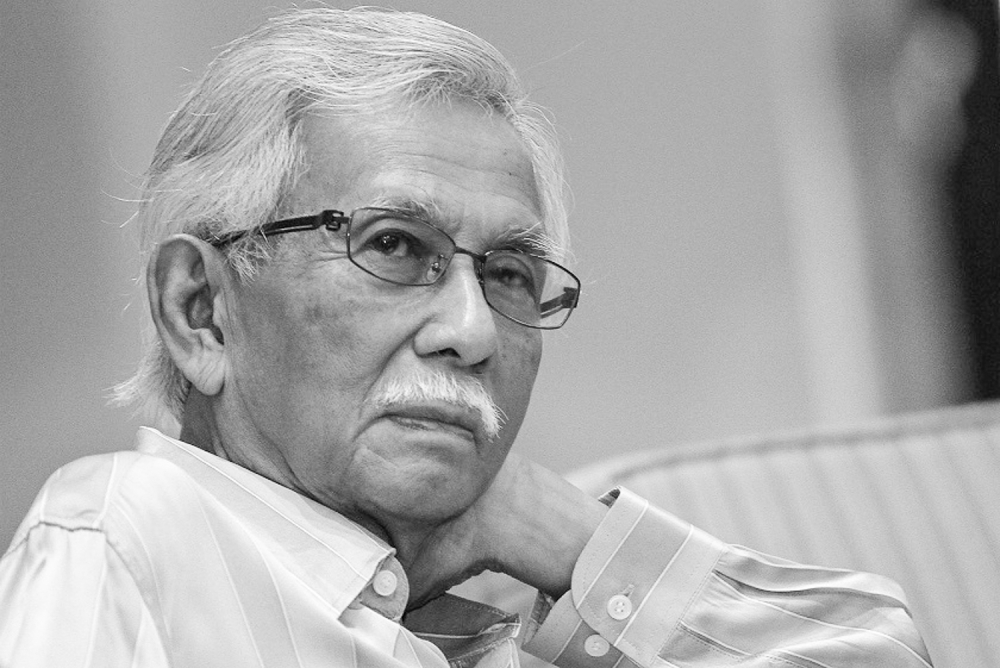

BNM governor Datuk Nor Shamsiah Mohd Yunus pointed out that a blanket moratorium on repaying bank loans “will not be in the best interests of the economy”, as allowing all borrowers — even those who can afford to resume repayments — to postpone payments would be similar to kicking the problem down the road.

“While it puts more money in people's pockets in the short term, it creates a lot of economic distortions and has a negative economic impact,” she told the media in an online briefing today, when responding to a question on calls from both government and opposition politicians for the blanket loan moratorium to be extended.

Malaysia had shifted from the six-month blanket loan moratorium from April to September, to the current targeted repayment assistance starting from October where only borrowers who truly need help in postponing or reducing monthly loan installments would be given such assistance by banks.

In explaining why it would be detrimental to Malaysia’s economy to continue giving a loan moratorium in a blanket manner to all borrowers, Nor Shamsiah said it would cause banks’ liquidity or cashflow to suffer and discourage them from giving out new loans that would be crucial to help the Malaysian economy recover.

“One, it will constrain new lending to households and businesses as bank buffers are depleted and banks become more risk averse,” she said.

She stressed the importance of preserving the capital and liquidity buffers of banks to ensure banks are able to continue to lend money to borrowers and to support the country’s economic recovery, noting that liquidity could be easily wiped out such as in past financial crises.

“While it is true that our banks currently have strong buffers, we have seen how quickly this can turn, from our own experience in the 1990s with the Asian financial crisis and elsewhere during the 2008 global financial crisis.

“In this environment and given our limited resources, Malaysia, as is the case with other countries, can ill afford a concurrent economic and financial crisis,” she said.

Secondly, Nor Shamsiah highlighted that the household debt to GDP in Malaysia is now already at an all-time high of around 90 per cent, arguing that an extension of the blanket loan moratorium would only cause overall debt levels to increase.

“These will constrain growth and hurt the economy down the road as more borrowers struggle under the weight of higher debt. A debt-driven growth is simply not sustainable,” she said, saying that borrowers who can afford to make payments should pay down their debts.

In her third reason for why it would not be good to extend the blanket loan moratorium beyond the April-September period, Nor Shamsiah indicated that it would not be in favour of Malaysians’ interests to do so — regardless of whether they are those who deposit their savings in banks or those who have an interest in banks via money kept in institutional investment funds such as the private sector’s retirement fund Employees’ Provident Fund (EPF) or the civil sector’s pension fund Retirement Fund Incorporated (Kwap).

“Three, it undermines the interests of millions of depositors that count on banks to keep their money safe, and also the interests of millions of Malaysians that are shareholders of banks through their savings with funds like ASB (Amanah Saham Bumiputera), in their EPF retirement savings, Tabung Haji, and pensions in KWAP,” she said.

She noted that public confidence and trust in Malaysia’s banking system and banking sector stability must be preserved, adding: “Whatever we do, we must remember that banks safeguard the hard-earned savings of all Malaysians. It is also through their new lending that banks are able to support the economy.”

Nor Shamsiah noted that the blanket loan moratorium was among exceptional measures that were necessary at the onset of the Covid-19 pandemic and when the movement control order (MCO) was first implemented in March, but said that it would not be right to continue using this measure now.

“Despite recent developments, the economy continues to track a recovery path. We are seeing that around 85 per cent of borrowers have resumed their loan repayments since we transitioned to targeted repayment assistance. We expect this number to rise further, as the economy gradually improves.

“In other words, many borrowers can and want to pay down their debt. This is an encouraging sign for our economy. Re-imposing a blanket moratorium would not be a proportionate or responsible response in these circumstances,” she argued.

Today, the latest figures by the Department of Statistics Malaysia (DOSM) showed that Malaysia’s economy has recovered from the gross domestic product (GDP) growth rate of -17.1 per cent in the second quarter of 2020, to an improved rate of -2.7 per cent in the third quarter of 2020.

BNM today said it will be maintaining its projected economic growth rate for 2020 at a range of between -3.5 per cent to -5.5 per cent, while saying that Malaysia is on track to recovery with the projection of a rebound for 2021 at a positive growth rate of between 6.5 per cent and 7.5 per cent.