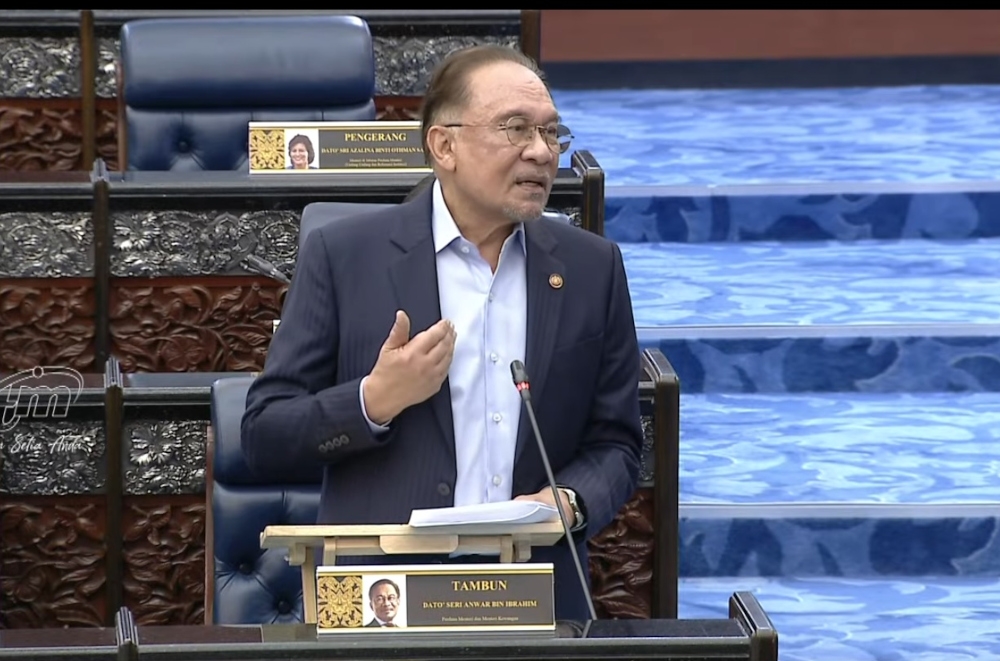

KUALA LUMPUR, Jan 20 — The ringgit extended this week’s loss before Prime Minister Najib Razak holds a special session on Malaysia’s economic developments amid a plunge in oil prices.

The currency has weakened 11 per cent in six months on concern that the drop in Brent crude will reduce earnings for Asia’s only major oil exporter. Investors are focused on whether Najib will make any adjustments to the 2015 budget assumptions, including the fiscal deficit target, economic growth estimates and the ringgit.

“Najib’s update on the economic and fiscal position today will be the main domestic focus for the ringgit,” said Khoon Goh, a Singapore-based strategist at Australia & New Zealand Banking Group Ltd. “The decline in oil prices is the main reason for the ringgit’s weakness.”

The currency fell 0.5 per cent to 3.5875 a dollar as of 9.48am in Kuala Lumpur, adding to yesterday’s 0.4 per cent loss, according to data compiled by Bloomberg. The ringgit dropped to 3.6045 on January 14, the lowest since 2009.

Ten-year government bonds were little changed, with the yield on the July 2024 notes at 3.94 per cent after rising two basis points yesterday, data compiled by Bloomberg showed.

Oil-related industries account for a third of Malaysian state revenue. The government, which has run a budget deficit since 1998, is seeking to trim the gap to 3 per cent of gross domestic product this year from 3.5 per cent.

The economy is forecast to expand 5 per cent to 6 per cent this year compared with an estimated 5.5 per cent to 6 per cent for 2014, according to the Finance Ministry’s October economic report. Official data tomorrow may show inflation slowed to 2.8 per cent in December from a year earlier, versus 3 per cent the previous month, according to the median forecast in a Bloomberg survey. — Bloomberg